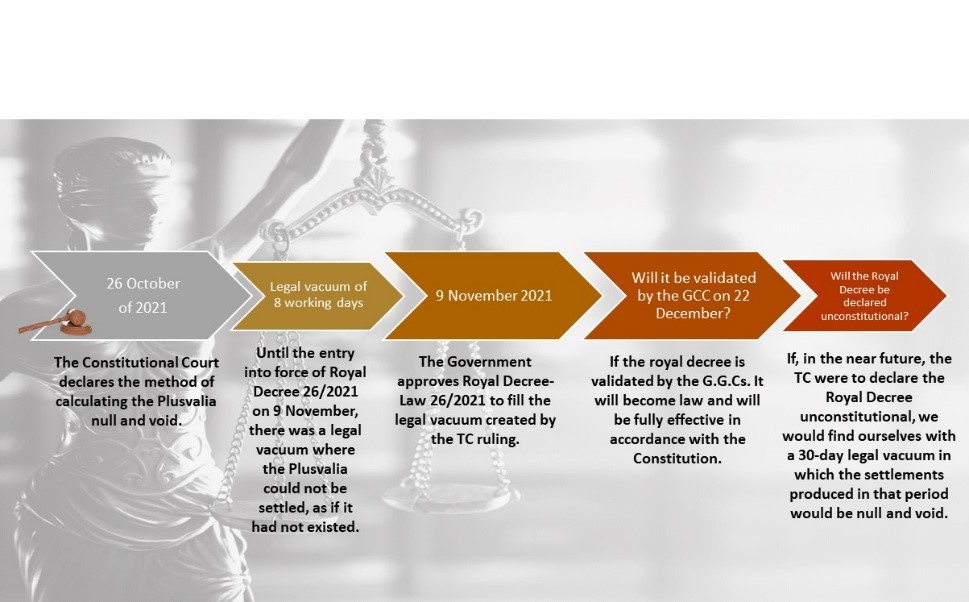

On 9 November, Royal Decree-Law 26/2021 of 8 November was published in the Official State Gazette, which fills the legal vacuum left by Constitutional Court Ruling 182/2021 on the calculation to determine the taxable base of the now colloquially known “Plusvalía”, which we have previously discussed in our blog (link here).

This legal route has been the most frequently used to fill the legal vacuum, but is it in accordance with the law?

Safeguarding the principle of legal reserve established in the Constitution and the General Tax Law, the Royal Decree-Law is a regulation with the status of law, and therefore has sufficient legal and legislative force to be used in this way.

However, Article 86.1 of the Spanish Constitution regulates these legal instruments for “cases of urgent and extraordinary necessity”, but “which may not affect […] the rights and freedoms of citizens regulated in Title I”. Where is the article that lays the foundations of tax law regulated? In Title I (Article 31 EC).

Although it might seem unconstitutional because of what we have mentioned, there is Constitutional Court case law which states that tax matters can be regulated by means of royal decrees-Law, but without affecting or regulating essential elements of taxation, since, in this case, it would have to be done by means of a law (issued by the Cortes Generales).

Following the Constitutional Court’s jurisprudence, this is where Royal Decree-Law 26/2021 would falter, given that what it regulates is the way in which the taxable event of the Tax on the Increase in Value of Urban Land is calculated, this being an essential element of all taxation.

On the other hand, the same article 86 of the EC establishes a period of 30 days for validation of the Royal Decree before the Spanish Parliament.

If this Royal Decree were validated before the Cortes, it would already have a valid normative character and its constitutionality would not be questionable.

However, the 30 days that this regulation has been passed by Royal Decree could lead to its unconstitutionality (always declared by the Constitutional Court) and, consequently, its nullity, thus generating a new legal vacuum.

At MDG Advisors we are waiting to find out if the Royal Decree will be validated and to find out all the effects on tax matters that this situation may entail and the possible unconstitutionality of the same, as well as trying to answer the questions that this whole situation raises. If you have any doubts in this regard, please do not hesitate to contact us to be attended by our tax advisors.